Strong partnerships are vital. No matter how good your idea, product or service, finding willing partners to share the load creates an entire community dedicated to success. Bank of the Pacific has spent the last 50 years working with small businesses across the Pacific Northwest to achieve mutual success. Even those who’ve gone to the birds, pigs, sheep, goats, turkeys and ducks, like Scratch and Peck feed.

Bank of the Pacific SBA Loans Supports Small Business Partners

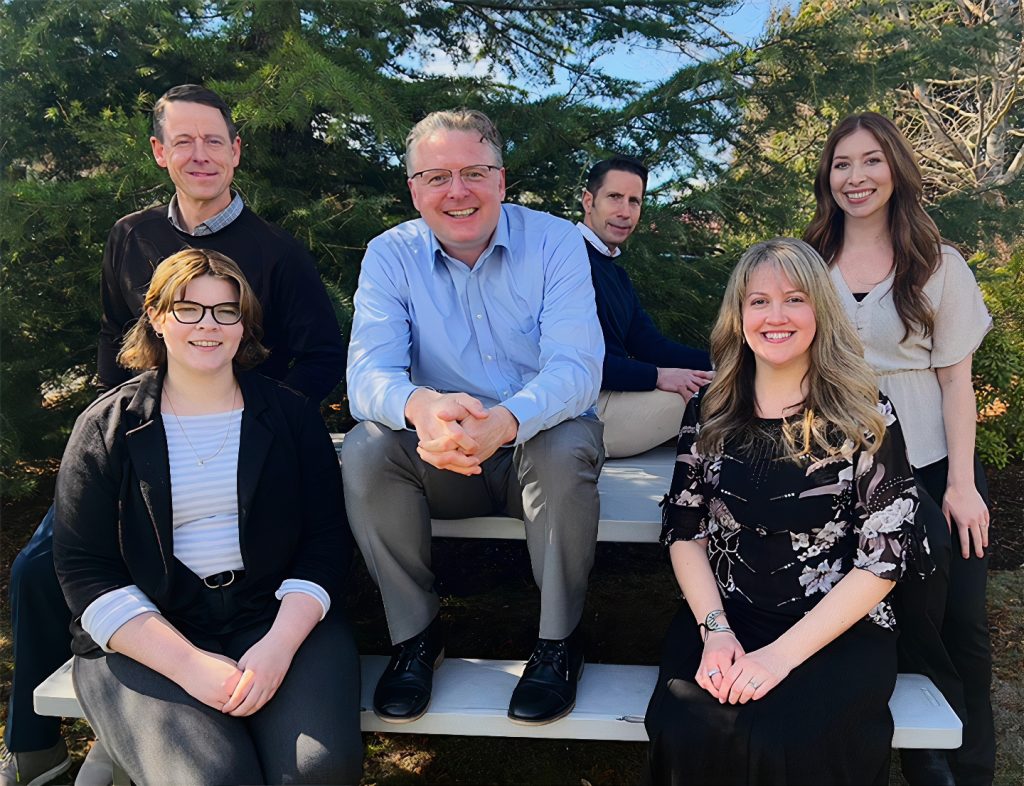

With Bank of the Pacific’s financial team for nearly 20 years, Commercial Banking Team Leader Jay Johnston appreciates how Bank of the Pacific has dedicated itself to both clients and team-members. He loves that they are small enough to give staff a voice in the bank’s future as well as the ability to work outside the box when needed. Both are thanks to a commitment towards open and honest communication at every step of a project, be it small business loans, SBA programs or even personal lending.

“Culturally we believe in an above average level of service,” says Johnston. By providing transparency and detailed financial insights about their small business partners, “we like to lift the veil and remove the black box. So many banks fail to provide this, and it leaves the client not understanding why the bank is acting or deciding the things it decides.”

Corporately they’ve dedicated themselves to being what Johnston calls a high touch and high value-added provider. “In recent years we’ve been providing our financial analysis and insights back to the client and discuss current risk and best methods to grow their business and meet long-term goals,” he adds.

Bank of the Pacific typically works with small and mid-sized businesses, and focuses on real estate and investment opportunities as needed. From SBA loans and credit services to cash management, fee reduction, financing, business banking and long-term planning, they promise to always put the customer first. Whether replying to messages quickly and clearly or showing how much they care both for the bank and each client, at Bank of the Pacific, it’s all about relationships.

Business Banking Helps Scratch and Peck Feed Care for Four-Legged Family

Scratch and Peck Feeds Mill makes high quality, whole grain, locally sourced animal feeds. In 2012 they became the first Non-GMO Project Verified animal feed manufacturer in North America and earned USDA Organic Certification by 2013. Family owned; they believe in a simple motto: you are what your animals eat.

Founder and Chief Integrity Officer of Scratch and Peck Diana Ambauen-Meade partnered with Bank of the Pacific from day one. “I knew I wanted to work with a smaller, community-based bank and chose Bank of the Pacific because they were close and offered all the services I felt I needed,” she says.

Jay Johnston was their first commercial banking contact in 2010 and able to help provide the company with a much-needed line of credit, finance new forklifts and even assist with their large mill expansion in 2017. “They have always been there for us,” says Ambauen-Meade, “and I credit a large portion of our success to them.”

More than just everyday banking, she appreciates how Bank of the Pacific maintains incredible customer service, competitive services and an authentic interest in the company’s long-term success. She trusts them so much that they handle not only Scratch and Peck’s finances, but her own personal banking as well.

Learn About Bank of the Pacific Small Business Loans Today

If longstanding relationships and value-added service are what your company, organization or family finances need to grow, give Johnston and the Bank of the Pacific team a call today. You can reach their customer care team at 833.FOR.BOTP (833.367.2687) or call Johnston directly at 360.756.9178. He can explain different commercial business banking options and walk you through any behind-the-scenes risk factors that might pop up along the way.

For businesses, adding in resources like Small Business Administration (SBA) funding and programs is just part of Bank of the Pacific’s commitment to success. “We are always interested in trying to help businesses out,” says Johnston, “and if we can’t do it, we like to try to help them find some means to get it done through referrals or suggestions of other means.”

They echo Ambauen-Meade’s hope “to make a positive impact on the world today and for generations to come.” You can benefit your furry and fuzzy friends by shopping for her Scratch and Peck feed at your neighborhood retailer or online by animal type. Follow them on Facebook, Instagram and YouTube for the latest product launches, updates and tips. Working together, from the ground – or grub – up builds a healthy, resilient future for everyone.

Sponsored