Submitted by Jo Dallas for Peoples Bank

The coronavirus has impacted nearly every sector of our economy, including the real estate market. While much of the home-buying process is already online, like finding and touring homes, the pandemic has also brought about some changes to the loan approval process. If you’re wondering if now is the “right time” to buy or refinance a home, here are some things to consider.

-

Jo Dallas has been serving customers in the real estate industry for over 30 years. Photo courtesy: Peoples Bank Mortgage rates are at historic lows. I’ve experienced many ups and downs in the housing market over my 30-year career as a lender, and these are some of the lowest rates I’ve seen. What makes this market unique is that the record-low rates are coupled with record-high demand — and record-low inventories.

- Online applications facilitate remote loan approval. While the lending process was already becoming more streamlined, COVID-19 has accelerated the pace of change. You can now complete all the necessary steps for applying for a loan online. We’ve implemented a new intuitive and user-friendly online application system at Peoples Bank that collects the information required for loan authorization and provides clear instructions on what needs to be submitted electronically, like pay stubs, tax returns, or other qualifying documentation.

- Guidelines have tightened somewhat, but lending is available. Investors have adjusted some of their guidelines because of the increased risk brought about by the pandemic. For example, the minimum credit score requirement has increased, and lenders must dive deeper into borrowers’ financial situations. Self-employed borrowers should be prepared to share more information about your business, if and how you’ve been affected by COVID-19, and if you have other sources of capital. All borrowers should be prepared for the approval process to take a little longer, but that won’t affect your rate once it’s locked in. Fortunately, we’re starting to see some of the restrictions ease as lending risks are better understood.

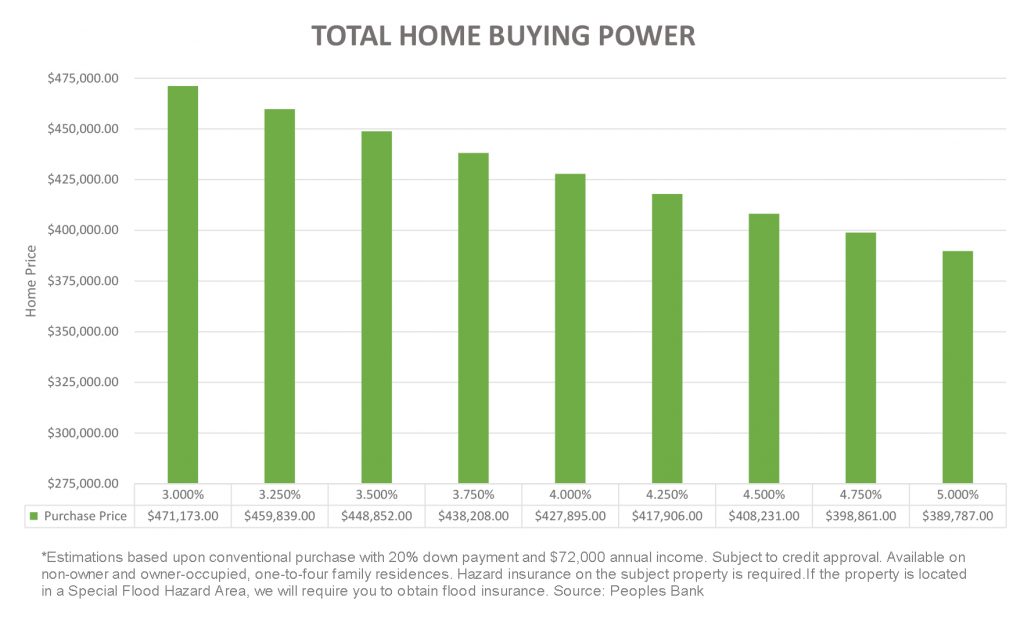

- Low rates bring more buying power. Lower rates allow borrowers to buy a more expensive home or pull more cash out of an existing home to do a remodel or other home improvement project. This chart gives you an idea of how interest rates correlate to buying power. It’s also important to consider the length of the loan. While longer-term loans have higher interest rates, they offer lower monthly payments, which provide more flexibility with cash flow. A shorter-term loan offers a lower rate, but a higher monthly payment. It’s amazing how putting a little extra toward the principal balance each month can save you over the life of the loan.

- It’s still a seller’s market. The lack of available inventory for affordable housing is still an issue now, despite COVID-19. Because demand is so high, buyers need to be ready to commit. This means being preapproved for a loan before you start looking for a home.

- The best time for refinancing is unique for each buyer. I often get asked what the “break-even” point is for customers looking to refinance a loan. The truth is the answer is different for everyone. Are you seeking debt consolidation? Do you want to lower your monthly payment? Do you need cash to make improvements to your home? How long do you anticipate owning the home? A lender can help you determine if it’s the right time to refinance your loan.

All signs point toward rates remaining low, potentially through next year. However, the market changes quickly. If you’re considering a new home purchase or a refinance, I recommend meeting with a loan officer to discuss your unique situation and get your questions answered. While COVID-19 has pushed many of our interactions online, our door is always open, just as it was before. Whether you’d like to schedule an in-person meeting, a phone call, or a video call, we’re happy to meet with you in the manner that works best for you.

Jo Dallas has been serving customers in the real estate industry for over 30 years. She is the Residential Production Manager for the Peoples Bank Real Estate Loan Division and manages the Peoples Bank Real Estate Loan Team’s operations. Contact Jo at jo.dallas@peoplesbank-wa.com or 360-650-5369.